Equip Your Child's Dreams: Discover the most effective Ways to Save for College

Equip Your Child's Dreams: Discover the most effective Ways to Save for College

Blog Article

Building a Solid Financial Foundation for University: Top Methods for Smart Preparation

As the price of college proceeds to increase, it has become progressively essential for trainees and their families to build a solid monetary structure for their higher education. In this discussion, we will discover the top approaches for clever economic preparation for university, consisting of setting clear goals, comprehending college costs, developing a budget plan and savings plan, checking out grants and scholarships, and considering pupil funding options.

Establishing Clear Financial Goals

Establishing clear economic objectives is an essential action in reliable financial preparation for university. As students prepare to embark on their higher education and learning trip, it is crucial that they have a clear understanding of their monetary purposes and the steps required to accomplish them.

The initial facet of establishing clear monetary goals is defining the price of college. This involves investigating the tuition costs, holiday accommodation costs, textbooks, and other various costs. By having a detailed understanding of the economic requirements, pupils can set reasonable and possible goals.

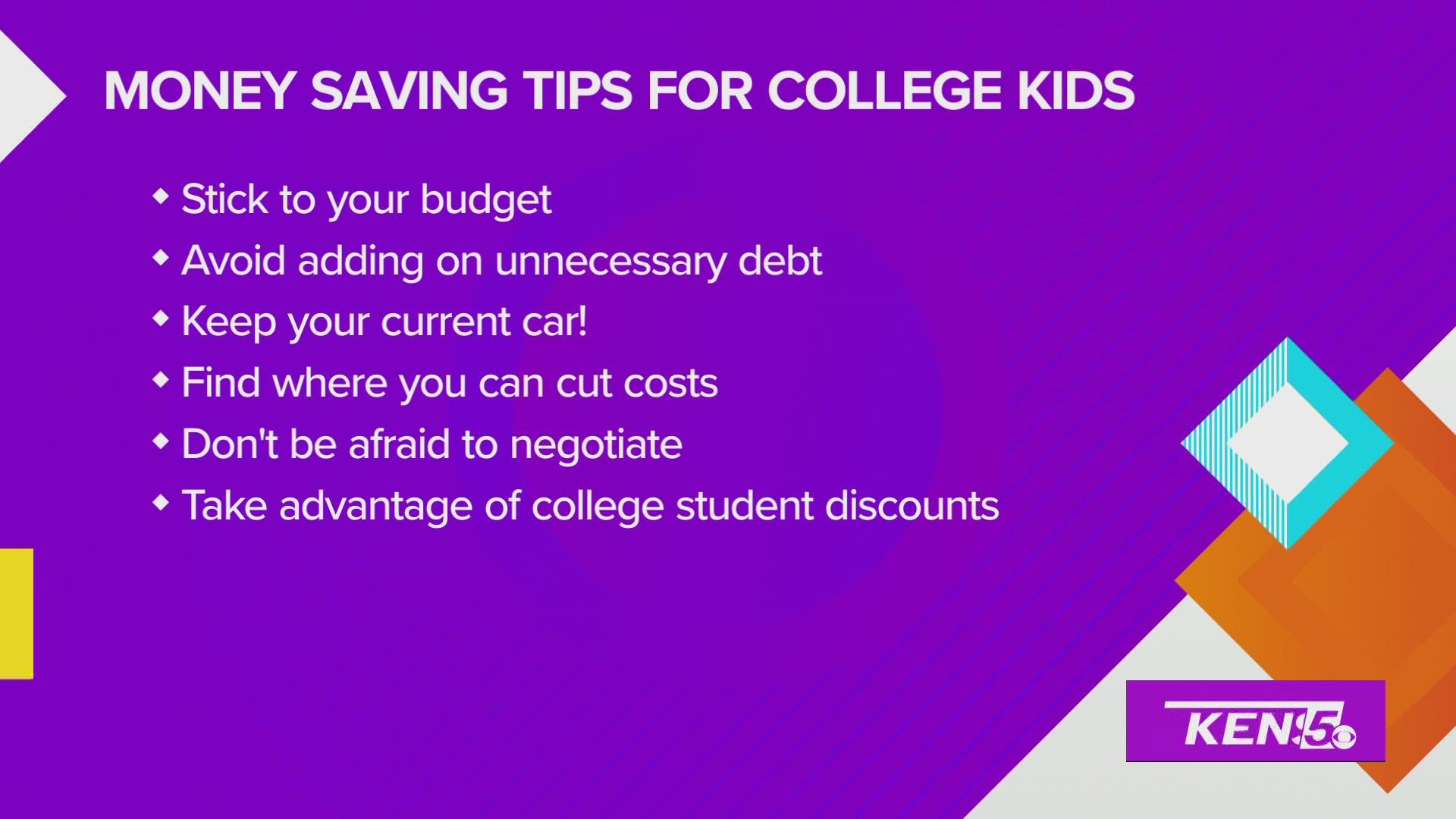

Once the price of college has actually been figured out, trainees must develop a budget. This involves evaluating their earnings, consisting of scholarships, grants, part-time jobs, and adult contributions, and afterwards assigning funds for essential costs such as housing, food, and tuition. Creating a budget plan helps trainees prioritize their costs and makes certain that they are not spending too much or accumulating unnecessary financial debt.

Furthermore, establishing clear financial objectives additionally includes determining the demand for cost savings. Trainees must determine just how much they need to save every month to cover future expenses or emergencies. By setting a savings goal, pupils can establish healthy economic habits and plan for unexpected conditions.

Comprehending University Prices

University expenses can vary dramatically relying on variables such as tuition fees, real estate expenditures, books, and other various fees. Understanding these prices is essential for reliable monetary preparation. Tuition charges are the most considerable expenditure for many university students. They can differ extensively depending upon the type of organization, program of study, and whether the student is an in-state or out-of-state resident. Real estate costs likewise play a substantial function in college expenses. Pupils can choose to live off-campus or on-campus, and the expense can differ relying on the area and amenities supplied. Books are another expenditure that trainees need to consider. The cost of books can be rather high, yet there are alternatives like renting or acquiring used books to conserve cash. Additionally, there are other assorted charges to take right into account, such as dish plans, transport, and individual expenditures. It is very important for trainees and their households to completely research study and recognize these expenses to develop a sensible budget plan and financial plan for university. By understanding the numerous elements of university costs, individuals can make informed choices and prevent unneeded monetary stress.

Developing a Budget Plan and Cost Savings Strategy

Developing a detailed spending plan and financial savings plan is necessary for efficient financial planning throughout university. As a trainee, managing your financial resources can be challenging, however having a budget plan in location will certainly assist you remain on track and prevent unneeded debt. The primary step in developing a budget plan is to determine your income and expenses. Beginning by listing all your resources of earnings, such as part-time tasks, scholarships, or economic aid. Next off, make a checklist of your regular monthly expenditures, including tuition costs, lodging, books, transportation, and personal expenses. It is essential to be sensible and prioritize your demands over desires. You can allot funds as necessary once you have a clear understanding of your revenue and expenses. Reserve a portion of your income for cost savings, reserve, and any type of future expenses. It is likewise essential to frequently examine your spending plan and make changes as required. University life can be uncertain, and unanticipated costs may develop. By having a financial savings strategy in position, you can better get ready for these circumstances and avoid financial stress. Remember, developing a budget plan and cost savings plan is not an one-time job. It requires regular monitoring and adjustment to ensure your economic security throughout your college years.

Discovering Scholarships and Grants

To optimize your funds for university, it is crucial to discover readily available scholarships and grants. Save for College. Scholarships and gives are a great way to fund your education and learning without having to rely greatly on lendings or individual cost savings. These financial assistances are commonly granted based upon a range of factors, such as scholastic success, sports performance, extracurricular participation, or monetary demand

Begin by looking into grants and scholarships provided by schools you have an check my site interest in. Numerous institutions have their own scholarship programs, which can supply significant financial aid. Furthermore, there are many outside scholarships available from companies, foundations, and businesses. Internet sites and on-line data sources can assist you find scholarships that match your qualifications and interests.

When getting grants and scholarships, it is necessary to pay attention to due dates and application requirements. Many scholarships call for a finished application, an essay, recommendation letters, and transcripts. Save for College. Make certain to comply with all instructions very carefully and send your application ahead of the due date to boost your chances of obtaining funding

Exploring Trainee Lending Options

When thinking about just how to fund your college education and learning, it is very important to explore the different choices available for trainee car loans. Pupil financings are a convenient and typical way for students to cover the prices of their education. Nonetheless, it is vital to understand the different kinds of student fundings and their terms before making a choice.

Another alternative is private trainee lendings, which are supplied by banks, lending institution, that site and various other private lending institutions. These financings usually have higher rate of interest and extra rigid settlement terms than government car loans. If federal financings do not cover the complete price of tuition and various other expenditures., personal financings may be needed.

Verdict

In final thought, developing a strong economic structure for university calls for setting clear objectives, comprehending the costs included, creating a budget plan and financial savings plan, and discovering scholarship and give opportunities. It is essential to think about all available choices, consisting of student lendings, while decreasing personal pronouns in a scholastic composing design. By adhering to these techniques for wise planning, students can navigate the financial elements of college and lead the means for a successful scholastic journey.

As the price of college proceeds to increase, it has actually become increasingly essential for pupils and their family members to build a solid monetary structure for their greater education. In this conversation, we will check out the top approaches for smart financial planning for college, consisting of establishing clear goals, understanding college expenses, producing a budget and savings plan, exploring gives and scholarships, and considering pupil loan options. It is essential for students and their households to extensively research and comprehend these expenses to develop a practical budget and economic plan for university. These financial aids are normally awarded based on a variety of variables, such as scholastic achievement, athletic efficiency, extracurricular participation, or monetary demand.

By complying with these methods for wise preparation, trainees can browse the economic elements of university and lead the means for a successful academic journey.

Report this page